Per Diem Rates Table 2026 for Germany and International Travel

Business travel is part of everyday operations for many companies. This may involve an important client meeting in another city or attending an international industry conference. At the same time, every trip comes with unavoidable travel and business expenses that affect both the company and the employees who are travelling.

Consider the following example. A sales manager travels to Berlin for a client meeting. The taxi ride from the airport, lunch with a potential customer and the ticket for a trade fair all contribute to the overall cost of the trip. While expenses such as train or flight tickets are usually reimbursed at their actual cost, meal expenses are generally covered through fixed per diem rates.

This becomes particularly relevant for companies with frequent business travel. A digital travel expense management process helps ensure that expenses are recorded correctly, per diem rates are applied consistently, and administrative effort is kept to a minimum.

Looking ahead to 2026, many companies are once again facing the same question. Which per diem rates currently apply, and what has changed compared to the previous year?

Per diem rates Germany 2026: Summary

- Germany: Domestic per diem rates for meals remain unchanged in 2026. The allowance is €14 for business trips involving an absence of more than eight hours and €28 for full days with an absence of at least 24 hours.

- International travel: International per diem rates are reviewed on an annual basis. For 2026, the German Federal Ministry of Finance (BMF) has reassessed selected countries and regions, resulting in adjusted rates for certain destinations.

- Rules and limits: The regulations on reducing per diem rates when meals are provided, as well as the three-month limit for tax-free allowances, remain unchanged in 2026.

- In day-to-day operations, international business travel often involves multiple destinations with different applicable rates. An automated expense management solution helps apply the correct BMF per diem rates for each trip and reduces the risk of calculation errors.

The application of per diem rates is always based on the current regulations issued by the German Federal Ministry of Finance (BMF).

These rates are reviewed and updated on a regular basis, typically at the turn of the year. To help you prepare for the year ahead, we have compiled the current per diem rates for Germany and international travel, effective from 1 January 2026.

Per diem rates 2026 for Germany and international travel

Per diem rates, including daily meal allowances, are reviewed each year for both domestic business travel within Germany and international business trips. Towards the end of the year, the German Federal Ministry of Finance (BMF) publishes an official list of per diem rates covering more than 180 countries and regions worldwide.

Per diem rates 2026 in Germany

From 1 January 2026, two domestic per diem rates continue to apply for business travel within Germany. For trips involving an absence of more than eight hours, a daily allowance of €14 may be claimed. For business trips with an absence of at least 24 hours, the applicable per diem rate is €28.

| Art der Pauschale | Betrag | Voraussetzung |

| Kleine Pauschale für eintägige Reisen | € 14 | Abwesenheit von mehr als 8 Stunden |

| Große Pauschale für mehrtägige Reisen | € 28 | Abwesenheit von mindestens 24 Stunden |

Note: The proposed increase in domestic per diem rates, which was discussed as part of a broader tax reform initiative, has not been implemented. As a result, per diem rates for business travel within Germany remain unchanged in 2026.

Overnight allowance for professional drivers 2026

From 1 January 2024, the overnight allowance for professional drivers was increased from €8 to €9 per calendar day. This rate remains unchanged in 2026.

Professional drivers can therefore continue to claim an overnight allowance of €9 for each night spent sleeping in their vehicle during a business trip.

International per diem rates 2026

Per diem rates for international business travel can differ significantly from those applied to domestic trips within Germany. When determining international per diem rates, the German Federal Ministry of Finance (BMF) takes local living costs into account and reviews the amounts on an annual basis.

For 2026, the BMF has reviewed the existing international per diem rates and adjusted them for selected countries and regions. The exact allowance that applies therefore continues to depend on the specific travel destination.

For arrival and departure days, the lower per diem rate of the respective country applies. If a single travel day involves multiple countries with different per diem rates, or if different rates apply within one country, the higher rate may be used.

Below you will find an excerpt from the official BMF per diem rates table, effective from 1 January 2026, covering some of the most common destinations for business travellers from Germany.

Excerpt from the per diem rates table 2026

| Country / region | Per diem rate (more than 8 hours) | Per diem rate (24 hours) |

|---|---|---|

| Netherlands | €39 | €58 |

| Belgium | €40 | €59 |

| Switzerland – Geneva | €47 | €70 |

| Switzerland – other regions | €46 | €68 |

| Austria | €33 | €50 |

| Luxembourg | €42 | €63 |

| Italy – Rome | €32 | €48 |

| Italy – Milan | €28 | €42 |

| Italy – other regions | €28 | €42 |

| France – Paris (and selected départements) | €39 | €58 |

| France – other regions | €36 | €53 |

| Spain – Madrid | €28 | €42 |

| Spain – Barcelona | €23 | €34 |

| Spain – other regions | €23 | €34 |

| United Kingdom – London | €44 | €66 |

| United Kingdom and Northern Ireland | €35 | €52 |

| Denmark | €50 | €75 |

| Finland | €36 | €54 |

Source: Official travel expense allowances published by the German Federal Ministry of Finance (BMF) for 2026.

All rates apply from 1 January 2026. Changes compared to the previous year are highlighted in bold in the official BMF table.

This overview shows that international per diem rates not only vary from one country to another, but in some cases also differ within the same country. An automated expense management solution helps apply these differences correctly and significantly reduces manual effort.

The evolution of per diem rates: Why international rates change more frequently than domestic ones

Per diem rates are reviewed annually by the German Federal Ministry of Finance (BMF). While domestic per diem rates for business travel within Germany have remained unchanged for several years, international per diem rates are adjusted on a regular basis.

This is primarily due to fluctuations in living and meal costs, regional price differences, and broader economic developments in the respective countries. These factors make it necessary to update international per diem rates more frequently, whereas domestic rates tend to remain stable over longer periods of time.

What you should know about per diem rates

Entitlement to per diem allowances

Employers are not legally required to reimburse travel expenses. If no reimbursement is provided by the employer, employees may claim per diem meal allowances as deductible work-related expenses as part of their annual income tax return.

For business travel within Germany, domestic per diem rates for meal expenses have remained unchanged since 2020:

- €14 for an absence of more than 8 hours

- €28 for an absence of at least 24 hours

These per diem rates continue to apply in 2026.

Please note that there is no separate annual tax-free allowance for per diem rates. Instead, the applicable per diem amounts may be claimed on a per-day basis as work-related expenses, provided that the employer has not reimbursed them tax-free.

Reduction of per diem rates

The rules governing the reduction of per diem meal allowances remain unchanged in 2026. If meals are provided by the employer, or by a third party at the employer’s request, the applicable per diem rate must be reduced on a daily basis.

When meals are provided, per diem rates are reduced as follows:

| Meal provided | Reduction | Example (based on a €28 daily per diem rate) |

|---|---|---|

| Breakfast | 20% | – €5.60 |

| Lunch | 40% | – €11.20 |

| Dinner | 40% | – €11.20 |

The reductions are always calculated based on the 24-hour per diem rate for the respective travel day, regardless of whether the actual absence lasts a full 24 hours.

Time limits for per diem payments

The payment of per diem meal allowances is subject to a time limit. In general, tax-free per diem rates may be applied for a maximum period of three months. This rule is commonly referred to as the three-month limit.

If an employee remains assigned to the same external work location for longer than three months, tax-free per diem allowances can no longer be paid or claimed as deductible work-related expenses.

The three-month limit applies to employees who have a primary place of work. It does not apply to employees without a fixed workplace, such as professional drivers or field technicians.

If an assignment at an external work location is interrupted for at least four consecutive weeks, the three-month limit resets, provided that the employee has not worked at the same location during this period.

The legal basis for this rule is set out in (Section 9 (4a), sentence 6 of the German Income Tax Act (EStG).

Note: The information provided in this article is intended for general guidance only. Travel expense regulations involve various special cases and exceptions. For legally binding advice, please consult a qualified tax advisor.

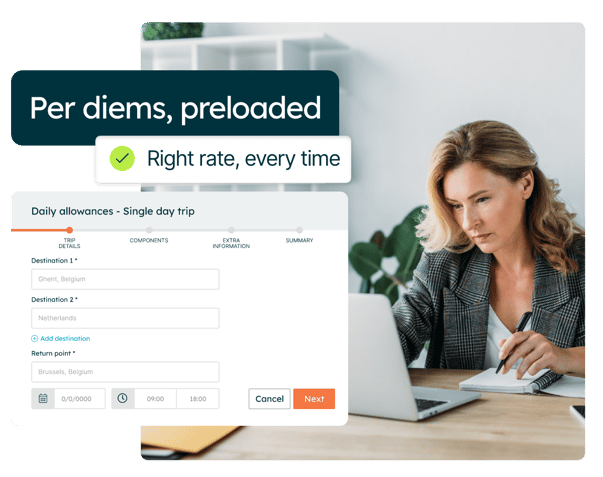

Simplifying expense reporting with the Mobilexpense app

The wide range of per diem rates, reduction rules and country-specific requirements highlights how complex travel expense reporting can be in practice. The Mobilexpense app automates the calculation of per diem rates, meal allowances and overnight costs, allowing employees to submit their travel expenses with minimal effort.

Employees simply enter their travel details, and the mobile app automatically applies the correct allowances based on the latest regulations issued by the German Federal Ministry of Finance (BMF). Company-specific travel and expense policies can also be stored easily, providing a high level of flexibility.

Thanks to its intuitive design, employees can capture expenses directly while travelling, while the app calculates all relevant amounts in the background. Finance teams benefit from automated expense management that reduce manual checks and free up valuable time.

The Mobilexpense app integrates seamlessly with existing accounting systems and enables fully paperless travel expense management that is efficient, compliant and free from unnecessary administrative effort.

FAQ: Per diem rates Germany 2026

From 1 January 2026, two domestic per diem rates continue to apply for business travel within Germany:

- €14 for an absence of more than 8 hours

- €28 for an absence of at least 24 hours

The overnight allowance for professional drivers also remains unchanged at €9 per calendar day.

International per diem rates for business travel vary depending on the destination. The German Federal Ministry of Finance (BMF) publishes an official list of applicable rates each year.

Examples of international per diem rates for 2026 include:

- Netherlands: €58

- Belgium: €59

- Switzerland (Geneva): €70

The full overview can be found in the official BMF publication on travel expenses and per diem rates for 2026.

Per diem rates must be reduced if meals are provided by the employer or by a third party at the employer’s request. The reduction is applied per travel day as follows:

- Breakfast: –20%

- Lunch: –40%

- Dinner: –40%

The calculation is always based on the 24-hour per diem rate for the respective day.

In general, per diem rates may be paid tax-free for a maximum period of three months. This so-called three-month limit begins on the first day of the external assignment.

If the assignment is interrupted for at least four consecutive weeks, the three-month period starts again.

The three-month limit does not apply to employees without a fixed workplace, such as professional drivers or field technicians.

The Mobilexpense app automates the calculation of per diem rates, meal allowances and overnight costs in line with the latest regulations issued by the German Federal Ministry of Finance (BMF).

Employees record their expenses digitally and on the go, while finance teams benefit from automated workflows that save time, reduce errors and ensure GoBD-compliant documentation in accordance with German tax requirements.

Share this

Other articles you might find interesting

5 Signs You Need an Alternative to Bank Cards for Expenses

/Listing%20Images/The%20rise%20of%20AI%20+%20ML_Listing%20Image.png)

8 Key Things to Consider Before Adopting an Expense Solution in 2026

/Listing%20Images/Higher%20Tax-Free%20Mileage%20Allowance%20From%202023%20in%20the%20Netherlands%20%E2%80%93%201.png)