Turn error-prone per diems into invisible expenses

Automate, localise and manage per diems.

Simplify reimbursement and save time for both employees and controllers.

Reduce the need for extensive documentation, allowing controllers to maintain better oversight.

Finance teams can predict and budget for expenses more accurately.

+3,000 customers trust us with expenses

The results you should expect from an automated expense management system

Time saved

Easier expense process by automating manual tasks such as data entry and sorting receipts.

Improved efficiency

Make better decisions with digitised processes and concentrate on more important work.

Money saved

Our streamlined administration and spend management solutions have helped our customers save millions.

Take back control of your business travel costs

Per diems minus the hours of manual checks

Configure your policies and eligible countries, globally or across Europe.Employees submit per diem requests via app or desktop.

The system calculates allowances, deductions, and generates compliant reports.

Approve and reimburse with confidence.

Smarter per diem management starts here

Customisable calculation

Automatically calculate daily allowances based on up-to-date local and international regulations.

In-house compliance team

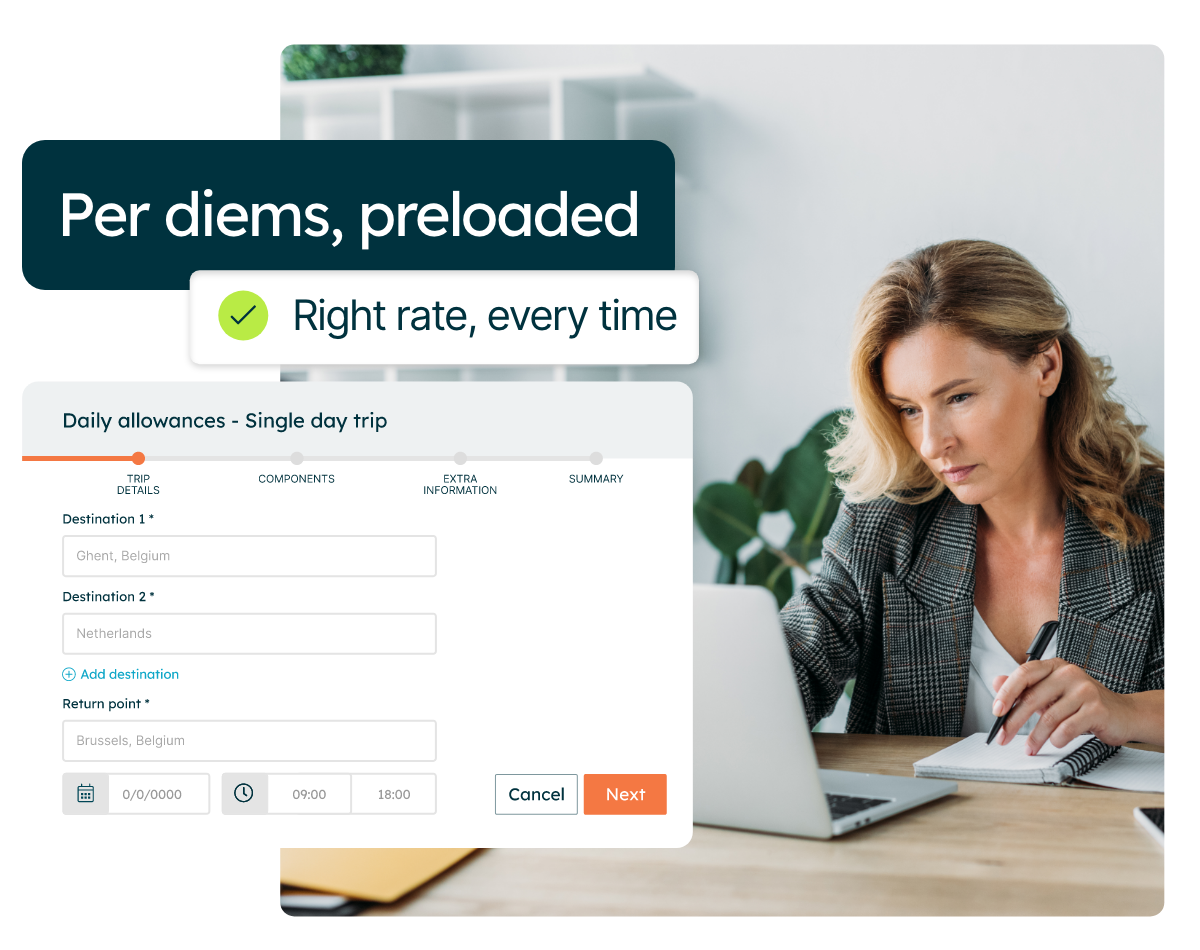

Easy trip entry

Users can enter the departure point, date, and time of travel. They can also add multiple destinations and trips.

Quick review and reporting

Customise policies per team or role

Setting rates for European offices? Or local field teams? Tailor per diem rules based on country, role, and internal policy.

Set policies for specific deductions

Your benefits with our per diem automation software

Bring your systems together

Spend less time reconciling and more time making decisions

Whether it’s your ERP, accounting software, HR system or travel provider, our smart integrations keep everything in sync.

Here’s what to expect:

Connect your existing tools with minimal IT involvement and no disruptions to daily work.

Automatically sync expenses, budgets and employee data across systems.

Save time on manual tasks and get clearer insight.

Great spend management tool? Proven results

Time saved

Easier expense process by automating manual tasks such as data entry and sorting receipts.

Satisfied customers

Make better decisions with digitised processes and concentrate on more important work.

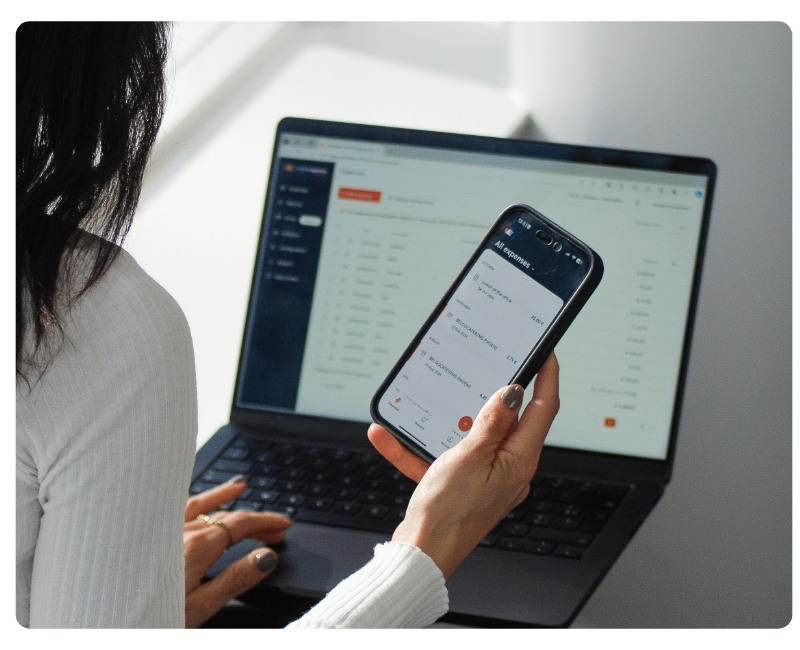

App downloads

Let your employees declare their expenses on the go with a simple photo and our OCR engine.

.png?width=1920&height=1080&name=E-book%20Compliance%20mockup%20(3).png)

Want to ramp up your compliance knowledge?

Here's what you'll find inside:

How to stay ahead of the mandatory e-invoicing laws.

CSRD and ESG: Insights into the new sustainability reporting rules.

How the latest per diem and legislation updates can impact your travel and expense policies.

Checklist for finance teams to stay ready and avoid penalties

Keep exploring our compliance resources

/Listing%20Images/How%20Manual%20Expense%20Management%20Affects%20Your%20Travel%20Policy.png?width=1920&height=1111&name=How%20Manual%20Expense%20Management%20Affects%20Your%20Travel%20Policy.png)

Mileage Rate and Per Diem Rates for UK 2025

/Listing%20Images/Easy%20Per%20Diems%20%E2%80%93%20Meaning%20And%20Examples%20(DE%2c%20BE%2c%20UK)%20%E2%80%93%201.png?width=1920&height=1111&name=Easy%20Per%20Diems%20%E2%80%93%20Meaning%20And%20Examples%20(DE%2c%20BE%2c%20UK)%20%E2%80%93%201.png)

The Meaning of Per Diems and Examples for DE, BE and UK 2024

/Listing%20Images/4%20Common%20VAT%20Compliance%20Issues%20And%20How%20To%20Avoid%20Them%20%E2%80%93%201.png?width=1920&height=1111&name=4%20Common%20VAT%20Compliance%20Issues%20And%20How%20To%20Avoid%20Them%20%E2%80%93%201.png)

2025 Per Diem Rates in Germany, Luxembourg and Austria

Frequently asked questions

A daily allowance, which is also known as per diem, is the limited amount of money an employee receives from their organisation to cover work-related expenses. Some examples of expenses include transportation or meals while traveling for business.

-

Customisable calculation: Companies can choose to follow our standard allowance calculation, or modify the rules to their unique needs.

-

In-house compliance team: When using the standard allowance template, our compliance team ensures that the rates meet the latest legal requirements for each country. Controllers can sit back and relax, knowing compliance is taken care of.

-

Easy trip entry: Users can enter the departure point, date, and time of travel. For multi-location trips, users can add multiple destinations and trips.

-

Automatic calculation: The daily allowance is automatically calculated based on the entered trip details.

-

Deductions: Companies can set policies for specific deductions from the original allowance. For example, breakfast may be deducted if included in the hotel price.

-

Quick review and reporting: Users can review the total trip calculation with a few clicks. The calculated allowance can be easily added to an expense report for approval.

-

Ease of administration: Employees receive daily allowances without submitting detailed expense reports. This simplifies reimbursement and saves time for both employees and controllers.

-

Increased cost control: Daily allowances reduce the need for extensive documentation, allowing controllers to maintain better oversight and ensure compliance with company policies.

-

Better cost predictability: Finance teams can predict and budget for expenses more accurately with fixed daily allowances, providing financial stability for the organisation.

-

Higher employee satisfaction: Daily allowances streamline the reimbursement process and provide transparency, making it convenient and clear for employees to understand their allowances.

Based on the given parameters, a per diem may vary. The rates differ between countries, and even cities. In the case of a per diem for food, the employee will only receive the full allowance if they have paid for all their meals themselves. If not, deductions must be made for the per diem to be compliant. This can happen for example if the meals are included in the cost of the lodging, or if the employee’s meal is paid for in another fashion (e.g. as part of an event, by a customer/supplier, etc.).

Up to date national and local per diem rates are uploaded in the system, along with a host of other features specific to German regulatory requirements. Our Compliance team proactively checks and maintains these rates and requirements, so that you don’t have to.

With Mobilexpense, the user enters the details of their trip (departure and return date and time, destination) and the system automatically calculates the appropriate per diem. The user can enter or edit these details either via our web app, or on our mobile app.

And if the user enters a separate claim for a meal during a trip with per diems, the system makes the appropriate meal deductions. At the end of the trip, the user submits their per diems for approval in a report with any other expenses related to that trip. Mobilexpense ensures the compliance of all expense items, and issues a warning in case of any deviation.

Dive deeper

Discover the key features for effortless expense management

Expense management and approval workflows

Real-time visibility and configure custom approval workflows.

/Mobilexpense%20brand%20image%20old11.png?width=800&height=650&name=Mobilexpense%20brand%20image%20old11.png)

Mileage tracking and travel allowances

Calculate distance and per diems accurately on the go.

Policy enforcement and business rules

Catch out-of-policy expenses before they’re submitted.