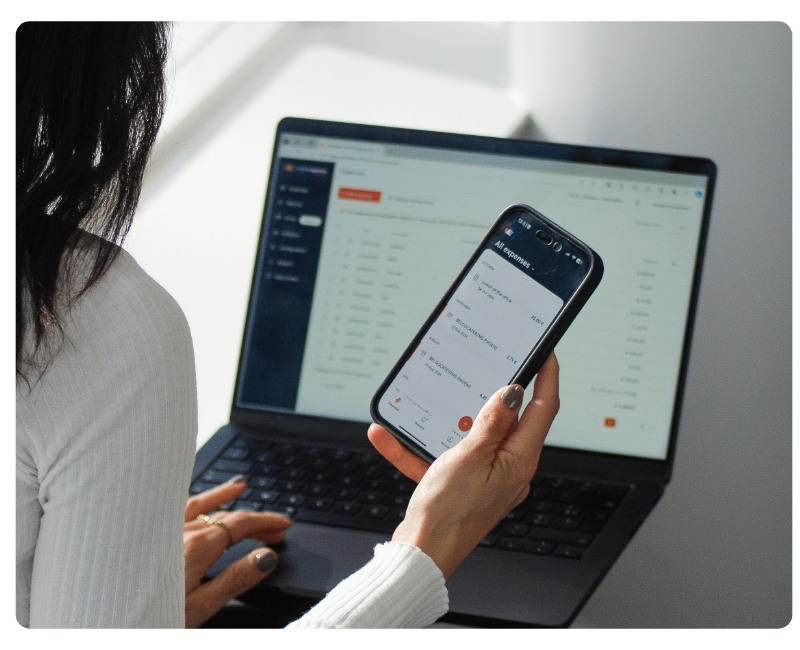

Reconcile spending in real-time across all business credit cards

Mobilexpense business credit cards give your team a smarter way to spend

- Instantly issue and manage cards from a central dashboard.

- Control spending with custom limits, vendor-specific cards.

- Employees stay compliant with automated policy enforcement.

.png?width=800&height=633&name=Landing%20Page%20Cards%20_Above%20fold%20(ENG).png)

.png?width=1080&height=1080&name=SpendLab%20(4).png)

Make the most of corporate credit cards

/Mobilexpense%20brand%20image%20old11.png?width=800&height=650&name=Mobilexpense%20brand%20image%20old11.png)

Stress-free travel management

Built for finance teams and business travellers who need flexibility, visibility, and speed.

Enforce company policy automatically

Admins can manage everything from one central dashboard. Issue, block, and adjust cards with a click.

Predictable global expense management

With 0% FX markup, your team spends worldwide without costing your business extra.

Already have bank cards? Bring them

We’re card agnostic, so there’s no need to switch providers

Bring your existing Visa, Mastercard and Amex cards and keep all the benefits that come with them:

- Retain your full transaction history.

- Avoid disruption to your current setup.

- Keep existing rewards or banking relationships.

More strategy. Less spend check with credit cards

Stop chasing receipts and reviewing every transaction manually

- Have confidence that spend stays within set limits and policies.

- Have peace of mind with cards restricted by vendor, amount, or timeframe.

- Benefit from real-time visibility into recurring and one-off expenses.

.png?width=800&height=633&name=Landing%20Page%20Cards%20Image%203%20(ENG).png)

All you need to create one harmonised

card management solution

0% foreign exchange markup

Perfect for international business spend.

Customisable spending limits

Automated policy enforcement

Real-time transaction tracking

Issue and block cards instantly

Vendor-specific card creation

Integration with ERP and HR tools

Apple Pay and Google Pay compatible

Central dashboard

Great for finance. Loved by HR.

Effortless for users.

/Mobilexpense%20brand%20image%20old25.png?width=800&height=650&name=Mobilexpense%20brand%20image%20old25.png)

Finance teams

/Mobilexpense%20brand%20image%20old3.png?width=800&height=650&name=Mobilexpense%20brand%20image%20old3.png)

HR and travel managers

/Mobilexpense%20brand%20image%20old46.png?width=800&height=650&name=Mobilexpense%20brand%20image%20old46.png)

Legal and IT managers

These customers use Mobilexpense cards

Start with this guide: From Bank Cards to Smart Corporate Cards: What Every CFO Needs to Know

Card management and expense management shouldn’t be separate.

Dive into how Mobilexpense Cards automate receipt matching, enforce policies in real time, and remove manual reconciliation.

.png?width=1200&height=675&name=EN%20E-Book%20credit%20cards%20mockup%20(2).png)

Read more about corporate credit cards

11 Challenges With Using Bank Business Credit Cards in Business

/Listing%20Images/Karten-Manage%C2%ADment%20Gesch%C3%A4ft%C2%ADli%C2%ADche%20Bankkar%C2%ADten%20richtig%20verwal%C2%ADten%20listing.png?width=1920&height=1111&name=Karten-Manage%C2%ADment%20Gesch%C3%A4ft%C2%ADli%C2%ADche%20Bankkar%C2%ADten%20richtig%20verwal%C2%ADten%20listing.png)

Master Expense Management with 0% FX Business Credit Cards

/Listing%20Images/5%20Expense%20Questions%20For%20CFOs%20at%20Year%20End.png?width=1920&height=1111&name=5%20Expense%20Questions%20For%20CFOs%20at%20Year%20End.png)

Optimise Employee Expenses with Business Credit Cards

Frequently asked questions

Registered corporations and private companies, associations and partnerships with good credit rating and sufficient credit card spend.

Mobilexpense offers modern corporate credit cards. Our convenient and easy-to-use card management platform allows for flexible setting of card limits and real-time reporting and seamlessly integrates with your existing setup of accounting and travel expense management tools and processes.

Mobilexpense offers Visa credit cards, both virtual and physical. Regarding physical cards, customers can choose between Blue (Visa Platinum Business) and Black (Visa Infinite Business credit cards). Mobilexpense is neither a prepaid nor a debit card and, therefore, is bank account independent, offers maximum card acceptance, and does not need to be charged in advance.

Mobilexpense business credit cards eliminate out-of-pocket expenses by giving employees direct access to company funds. Finance teams maintain control through spend limits, vendor-specific cards, and real-time management from a central dashboard.

Yes, bring your existing credit cards and we integrate with them.

Mobilexpense assigns security and data protection the highest priority. All personal data is stored in accordance with the European General Data Protection Regulation (GDPR). Critical card data are stored and processed in line with the very high data security standards of the payment card industry (PCI DSS). Additionally, Mobilexpense cards are enabled for 3DS to ensure additional protection for online purchases.

3D Secure is a free service facilitated by VISA that lets you transact securely on “Verified by Visa“ / “Visa Secure” online merchants using your Mobilexpense credit cards. It adds a security layer via an additional verification step. During this verification, you must provide a one-time password that is only available to you.

All Mobilexpense credit cards are automatically equipped with 3D Secure. During your online purchase you will receive the one-time password via SMS for the verification. You can then input this password into the verification page that will show the Visa logo and confirm the payment by clicking confirm / send. If the password is correct, the transaction will be successful and otherwise declined. Mobilexpense credit cards also work at merchants that do not participate in Visa 3D secure program.

This service is offered due to the EU’s Second Payment Services Directive (PSD2) which will mandate Strong Customer Authentication (SCA) before initiation of the payment. Therefore, Visa recently enhanced its security for online purchases including both e-commerce and m-commerce transactions to satisfy this new standard.

Learn more about Visa 3D Secure.

Cards are issued by Pliant Oy, identified by business ID 3266913-9, in accordance with a license from VISA Europe Limited. Pliant OY is recognized as an Authorized E-money payment institution and duly authorised and regulated by the the Financial Supervisory Authority of Finland.

*Terms and conditions apply.

Get a tailored product walkthrough

- A tailored walkthrough built around your company’s workflows and approval setup.

- Get expert guidance on integrating your ERP, HR, and card systems for a seamless flow.

- Deliver impact from day one - save time, enforce policies automatically, and scale seamlessly.