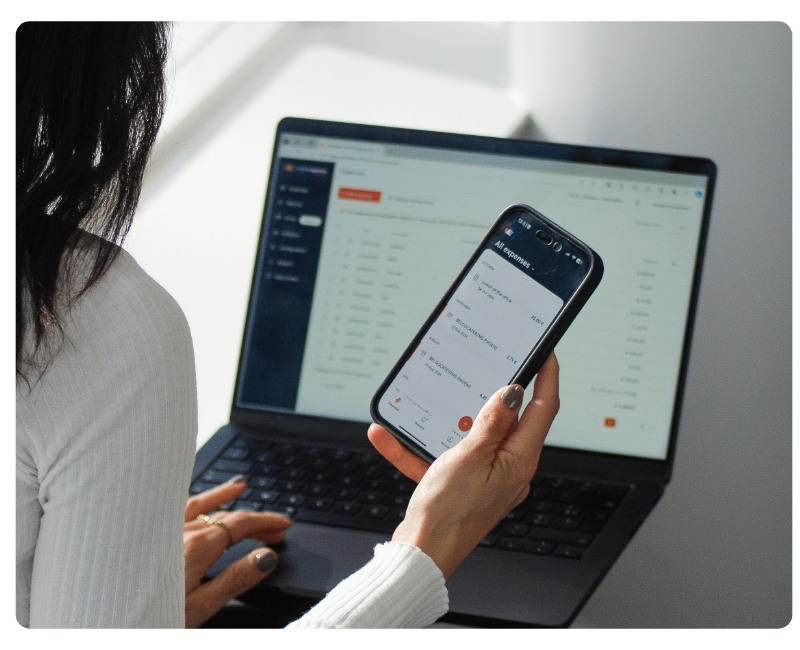

Expense management software for modern finance teams

Finance gains real-time visibility and faster approval cycles

- Track mileage and allowances effortlessly

- Stay in control with real-time logging and approvals

- Speed up reimbursements and cut admin stress

.png?width=1181&height=1181&name=Untitled%20design%20(6).png)

All the tools you need for expense harmony

Discover the key features for effortless expense management

Expense management and approval workflows

Real-time visibility and configure custom approval workflows.

.png?width=1200&height=950&name=Landing%20Page%20Cards%20Image%201%20(ENG).png)

Business credit cards

Bring your own or use our cards. You get granular control over employee spend.

/Mobilexpense%20brand%20image%20old11.png?width=800&height=650&name=Mobilexpense%20brand%20image%20old11.png)

Mileage tracking and travel allowances

Calculate distance and per diems accurately on the go.

Daily allowances (Per diems)

Built-in logic for European tax rules and per diem rates.

/Mobilexpense%20brand%20image%20old26.png?width=800&height=650&name=Mobilexpense%20brand%20image%20old26.png)

CO₂ tracking and reporting

Track carbon impact of travel and support sustainability.

Policy enforcement and business rules

Catch out-of-policy expenses before they’re submitted.

Uncomplicate the reimbursement process

Simplify approval workflows and ensure policies are enforced

.gif?width=350&height=622&name=Declaree%20-%20AI%20receipt%20scanner%20(1).gif)

Capture receipts without manual entry

Our Declaree by Mobilexpense AI receipt scanner reads, matches, and files every expense automatically.

Approvers get instant notifications

Automate approvals your way. Assign approvers, set workflows, and notify managers instantly.

Stay compliant, automatically

One system to stay compliant with internal policies and legal regulations alike.

Automated approvals

that are compliant with company policy

With Declaree, finance teams can easily detect out-of-policy claims, and streamline approvals with custom business rules.

- Smart flagging for out-of-policy expenses

- Custom fields for tailored control

- Compliance with local and EU regulations

%20Option%201.png?width=1200&height=950&name=Data%20%26%20Insights_Above%20fold%20(ENG)%20Option%201.png)

Introduce enjoyable workflows

- Work the way your company works by customising approval flows to fit your structure with smart automation.

- Keep processes moving by delegating tasks smoothly when someone’s away.

- Avoid delays by rerouting reports instantly so approvals don’t get stuck.

.png?width=1200&height=950&name=Travel%20Management_Image%203%20(ENG).png)

Built with finance leaders, for finance leaders

reduction in time on credit card reconciliation

less admin related to a trip

visibility into spend

Bring your systems together

Spend less time reconciling and more time making decisions

Whether it’s your ERP, accounting software, HR system or travel provider, our smart integrations keep everything in sync.

Here’s what to expect:

- Connect your existing tools with minimal IT involvement and no disruptions to daily work.

- Automatically sync expenses, budgets and employee data across systems.

- Save time on manual tasks and get clearer insight.

Who is our expense solution built for?

/Mobilexpense%20brand%20image%20old25.png?width=800&height=650&name=Mobilexpense%20brand%20image%20old25.png)

Finance teams

/Mobilexpense%20brand%20image%20old3.png?width=800&height=650&name=Mobilexpense%20brand%20image%20old3.png)

HR and travel managers

/Mobilexpense%20brand%20image%20old46.png?width=800&height=650&name=Mobilexpense%20brand%20image%20old46.png)

Legal and IT managers

Backed by customer testimonials and real-world results

.png?width=100&height=100&name=VdR%20-%20Der%20Tabakmittelstand%20(100x100).png)

"We probably saved 80% of our time just around matching credit card statements."

Maximilian van Ackeren, Head of SME and Technical Regulation

"I can import expense reports in just a few minutes. It used to take hours"

Betty Bajec, HR and Payroll Administrator

"The app is very easy to understand. It’s really good."

Benjamin Zajonskowski, Project manager at RIL

Get the guide:

The State of Expense Management in 2026

84% of CFOs say manual processes block digital transformation.

Get your guide and find out what’s costing you time, control, and visibility.

Frequently asked questions

1. Expense capture

Employees record expenses digitally using a mobile app or web platform.

They can upload receipts by taking a photo, forwarding an email invoice, or syncing their corporate card. Advanced tools use OCR (optical character recognition) to extract key information such as amount, date, and vendor details automatically.

2. Policy check and categorisation

The system compares the expense against company policies (e.g. spending limits, approved categories) and flags any violations. It also forms expense categories and links it to relevant projects, cost centres, or departments.

3. Submission

Employees submit their expense reports through the platform. In some systems, the submission can be automated based on predefined rules or thresholds.

4. Approval workflow

Expenses are routed to the appropriate manager or finance team member for approval, based on the employee’s role, the amount, or the expense category. Any anomalies or out-of-policy items are flagged for review.

5. Reimbursement or reconciliation

Once approved, expenses are either reimbursed directly to the employee or matched with company card transactions. The platform often integrates with payroll or accounting systems to streamline this process.

6. Reporting and analytics

All expense data is automatically recorded, creating a real-time overview of company spending. Finance teams can generate reports for budgeting, compliance audits, and forecasting.

Automated expense management is a digital process that uses software or technology to record, track, submit, approve, and reimburse business expenses with minimal manual input.

It typically involves integrations with accounting systems, mobile apps for receipt capture, and automation rules to ensure compliance and speed up financial workflows.

For more terminology, check out our glossary.

Mobilexpense integrates seamlessly with a wide range of accounting and ERP systems, including SAP, Microsoft Dynamics 365 and Exact . These integrations help automate expense data transfer, streamline reconciliation, and improve compliance by ensuring that expense records are accurately reflected in your financial system.

With customisable workflows and API or file-based integrations, Mobilexpense can adapt to your current setup—minimising manual work and reducing the risk of errors. Whether you're using a cloud-based solution or a more complex ERP system, Mobilexpense ensures your expense data flows smoothly into your accounting environment.

With over 20 years of experience, we understand that no two companies manage expenses the same way. That’s why our solution isn’t a rigid all-in-one tool. Instead, it’s a flexible, modular platform designed to fit your unique workflows, approval structures, and compliance requirements.

Unlike other providers, we don’t force you to use our corporate card. You can use our card, your own existing cards, or a mix, the choice is yours.

Key benefits include:

- Automated expense reporting and approval flows

- Real-time visibility into employee spend and budgets

- Built-in compliance features to support tax and audit requirements

- Easy integrations with ERP, payroll, and HR systems

- Freedom to choose your preferred payment methods and cards.

We focus on simplifying your expense process, not locking you into one way of working.

Yes. We are proud to be ISO 27001:2013, ISAE 3402 Type II and PCI DSS certified as well as TISAX and GDPR compliant - your data is safe with us.

Modern systems offer OCR (Optical Character Recognition)/ AI scanning technology that extracts data from receipts instantly. Employees can take a photo using a mobile app, and the tool auto-fills expense fields, reducing manual entry.

Get a tailored product walkthrough

- A tailored walkthrough built around your company’s workflows and approval setup.

- Get expert guidance on integrating your ERP, HR, and card systems for a seamless flow.

- Deliver impact from day one - save time, enforce policies automatically, and scale seamlessly.

-png-4.png?width=1391&height=322&name=Ratings%20Banner(Desktop)-png-4.png)