How Mobilexpense Cards Reshaped Our Company's Spending Landscape

Discover how our own struggles with company credit cards led to the creation of our new offering - Mobilexpense Cards. Integrated with our Declaree expense management software for a seamless experience.

The challenge: traditional vs modern credit cards

Our credit card journey was filled with obstacles that are commonly associated with traditional credit cards. Just like many other companies, we used to rely on a single corporate credit card that was passed around as needed. This card was initially issued to the Financial Director, but once he left the company, the card was naturally cancelled. This cancellation resulted in a multitude of automated payments failing or being cancelled as well.

Getting a card for our new CFO turned into a time-consuming and complicated process, requiring personal visits to the Chamber of Commerce and the bank, as well as dealing with a mountain of paperwork.

Once we finally got the new card sorted, we decided that a single traditional credit card was a liability for our company, and we set out to find a better solution. After all, we know how to do quality expense management, and this was not it.

The goal: simplified card access, no reliance on the bank, seamless integrations

Our objective was clear: streamline access and utilisation of the card, reduce reliance on the bank, and seamlessly integrate card functionalities into our own expense management system. Managing the card had to be effortless for us online, while empowering our colleagues with greater spending autonomy within predefined boundaries.

Implementation

Experiencing our own credit card challenges opened our eyes to the struggles our customers may be facing. As we carefully assessed various options and providers, we made the decision to introduce our own corporate card solution. This innovative solution seamlessly integrates with our expense management system, effortlessly capturing transactions and encouraging users to snap photos of their receipts on the move.

Benefits

We are proud of the incredible benefits and advantages that our Mobilexpense cards solution brings to our company.

Bas Janssen

Head of Strategic Initiatives at Mobilexpense

There are countless reasons why we couldn't be happier with this innovative solution.

- No more out of pocket expenses. While expenses still require validation and tracking, the burden of financing company costs was lifted from our employees.

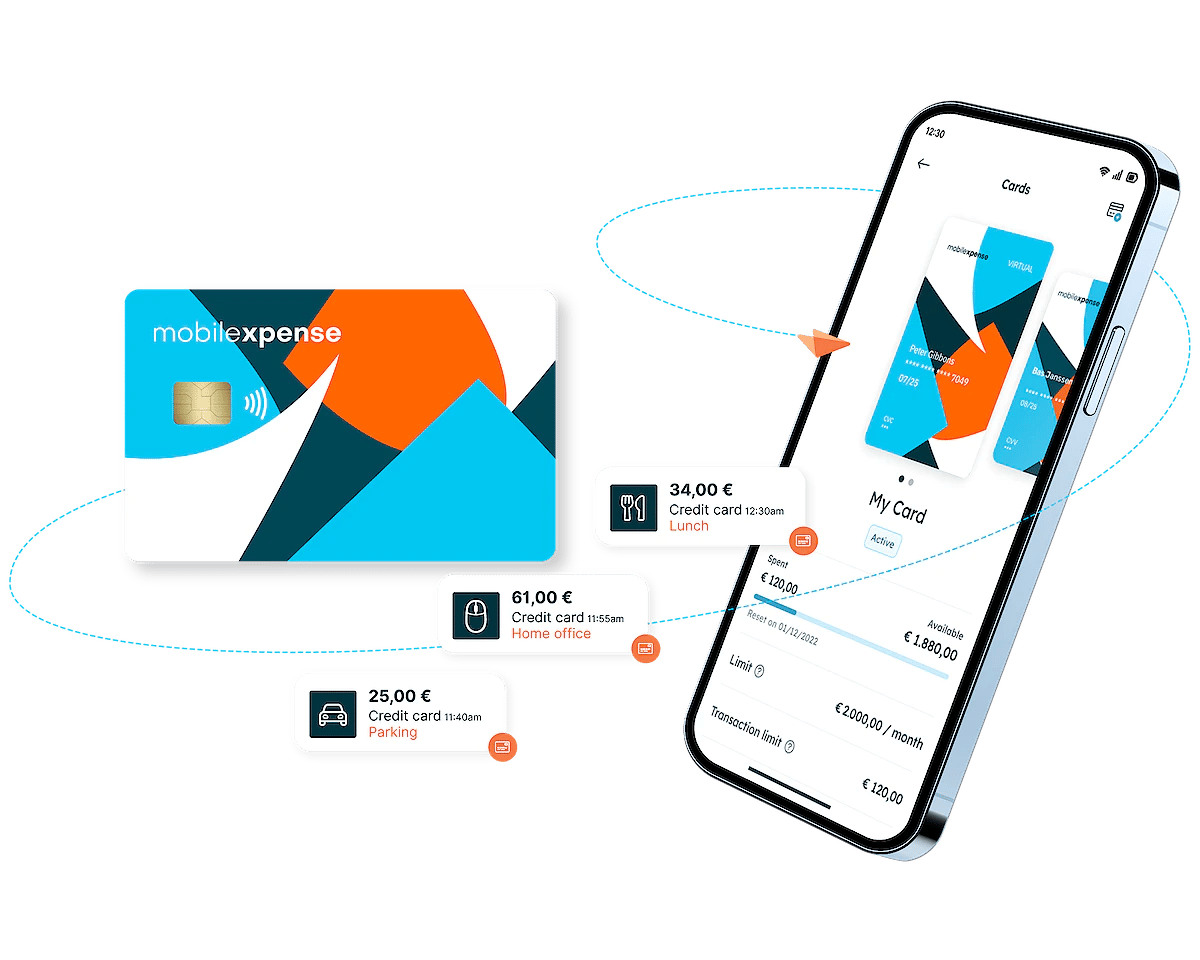

- One type of expense per card. With unlimited virtual cards available to us, we are able to allocate one card per type of expense, making it a breeze to categorize expenses and obtain a clear overview.

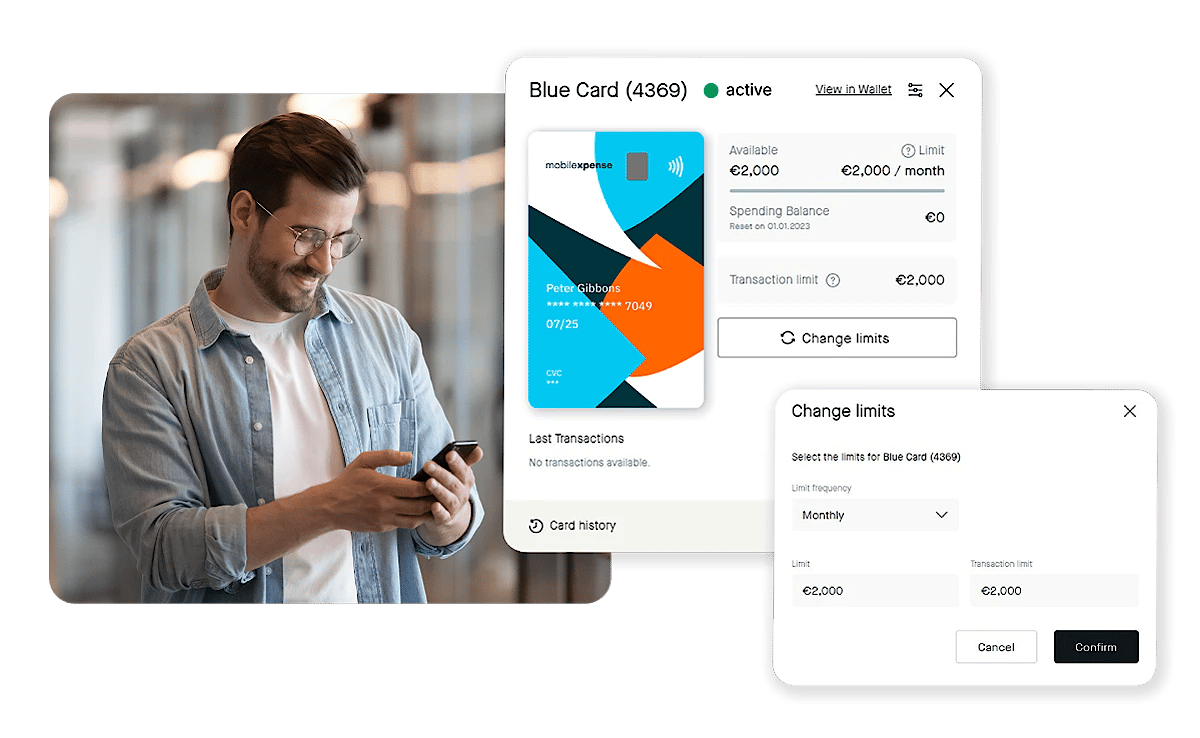

- More practical, more convenient. Our colleagues can conveniently request a new card as well as freeze or block a card from our own app. And setting or changing monthly spending limits is just as easy.

- Transparency saves money. Real-time transactions offers our Finance department enhanced control and transparency as well as guaranteed policy compliance. While we have more cards in use than previously, we also have a much clearer overview on spend which allowed us to cancel subscriptions we were paying for but no longer using.

- We strengthened our employer-employee relationships. Entrusting more employees with their own cards has lead them to spend even more carefully and mindfully of business objectives.

- We are better protected from risky transactions. With access to single-use virtual cards, we have been able to mitigate security concerns of one-time purchases from unknown vendors. Once the purchase is made, the card is deactivated and can no longer be charged.

Impact

Our employees have gained significant autonomy over their own spend, without the consequence of overspending or having to dip into their own pockets for company expenses.

Bas Janssen

Head of Strategic Initiatives at Mobilexpense

We are delighted to finally be extending our credit card solution to our customers. Having tested it ourselves for many months, we are confident to be delivering the best mix of functionality and flexibility we are known for among our customers. Because yes, our customers can choose to still integrate any of their company cards with our expense solution, not just Mobilexpense Cards.

By confronting obstacles head-on, aligning with our goals and the needs of our customers, and evaluating the results, we have not only optimised our internal financial procedures but also improved our operational effectiveness and the value we provide to our customers.

About the company

We help companies save up to 65% on their travel and expense processes.

Over 3.000 customers with 1.7+ million users rely on our solutions that guarantee expense compliance in 70+ countries.

150+ employees

20+ years of experience in expense management

22.000 expense reports filed/year

Get a tailored product walkthrough

- A tailored walkthrough built around your company’s workflows and approval setup.

- Get expert guidance on integrating your ERP, HR, and card systems for a seamless flow.

- Deliver impact from day one - save time, enforce policies automatically, and scale seamlessly.

-png-4.png?width=1391&height=322&name=Ratings%20Banner(Desktop)-png-4.png)

Title to introduce a program day, benefit, challenge etc.

More in-depth information about this, but keep it simple. What to expect, why should they follow the link? Commodo iaculis rutrum felis at. Cras sed fermentum morbi a pulvinar eget tristique. Quis mauris nunc egestas suspendisse felis. Pellentesque blandit laoreet.

Title to introduce a program day, benefit, challenge etc.

More in-depth information about this, but keep it simple. What to expect, why should they follow the link? Commodo iaculis rutrum felis at. Cras sed fermentum morbi a pulvinar eget tristique. Quis mauris nunc egestas suspendisse felis. Pellentesque blandit laoreet.

Meet some of our experts / speakers

We’ve got over 100+ experts / speakers

Action to convert for [type of content]

Lorem ipsum dolor sit amet, consectetur adipiscing elit.