Why Employees Prefer Mobile Expense Tracker Apps For Receipts

For employees, getting their own money back from expenses shouldn’t be a chore.

Controllers, we're talking to you.

In this article, you can learn more about why mobile expense tracking app is transforming how businesses and employees handle invoices and receipts.

With real-time receipt capture, seamless integrations, and smart policy enforcement, mobile apps are not just a nice-to-have, they’re a becoming a part of expectations.

Why employees love mobile apps for their expenses

1. They can submit expenses on the go

Employees no longer have to hoard paper receipts, wait to return to the office, or struggle to recall lunch meetings from weeks past.

With a mobile expense app, they can capture, categorise, and submit expenses in real time. This reduces errors, improves accuracy, and removes the cognitive load of managing expenses post-trip.

2. They have fewer lost or damaged receipts

Receipts get crumpled, lost, or soaked in coffee. Travelling, especially internationally, adds stress and increases the chance of misplacing vital documentation.

With mobile expense tracker app, receipts are just scanned and instantly saved to the cloud. Read more about how to claim your expense with lost receipt affidavit.

3. They save time with a simpler process

No more fiddling with spreadsheets, sticking receipts to bits of paper, or digging through old emails to fill out forms. With a mobile app, employees can log their expenses in just a few taps.

What used to be a frustrating, time-consuming task now takes just a minute or two.

4. They can access it anytime, anywhere

Thanks to cloud connectivity, employees can submit and review expenses wherever they are.

Whether working from home, the road, or an overseas office, they have full access to their reports, per diems and submission history.

5. They know finance will have more clarity and control over spending

A mobile expense app doesn’t just benefit finance teams, it gives employees visibility into their own spending.

Integrated policies and automatic feedback make them more conscious of costs, which leads to smarter decision-making and better alignment with corporate travel guidelines.

%20Option%204.png?width=1260&height=950&name=Data%20%26%20Insights_Above%20fold%20(ENG)%20Option%204.png)

6. They receive instant feedback and notifications

Declaree notifies users when required fields are missing, a receipt is unsubmitted, or a policy has been breached.

This immediate feedback helps users correct issues before they escalate. It also means employees no longer need to chase the finance team for status updates, everything they need is in the app.

7. They know simpler processes mean faster reimbursements

With faster submission and automated expense management (more on that below), reimbursements are processed quicker. That’s especially good for employee satisfaction, especially when they've paid out of pocket during business travel.

How our mobile expense tracker app works:

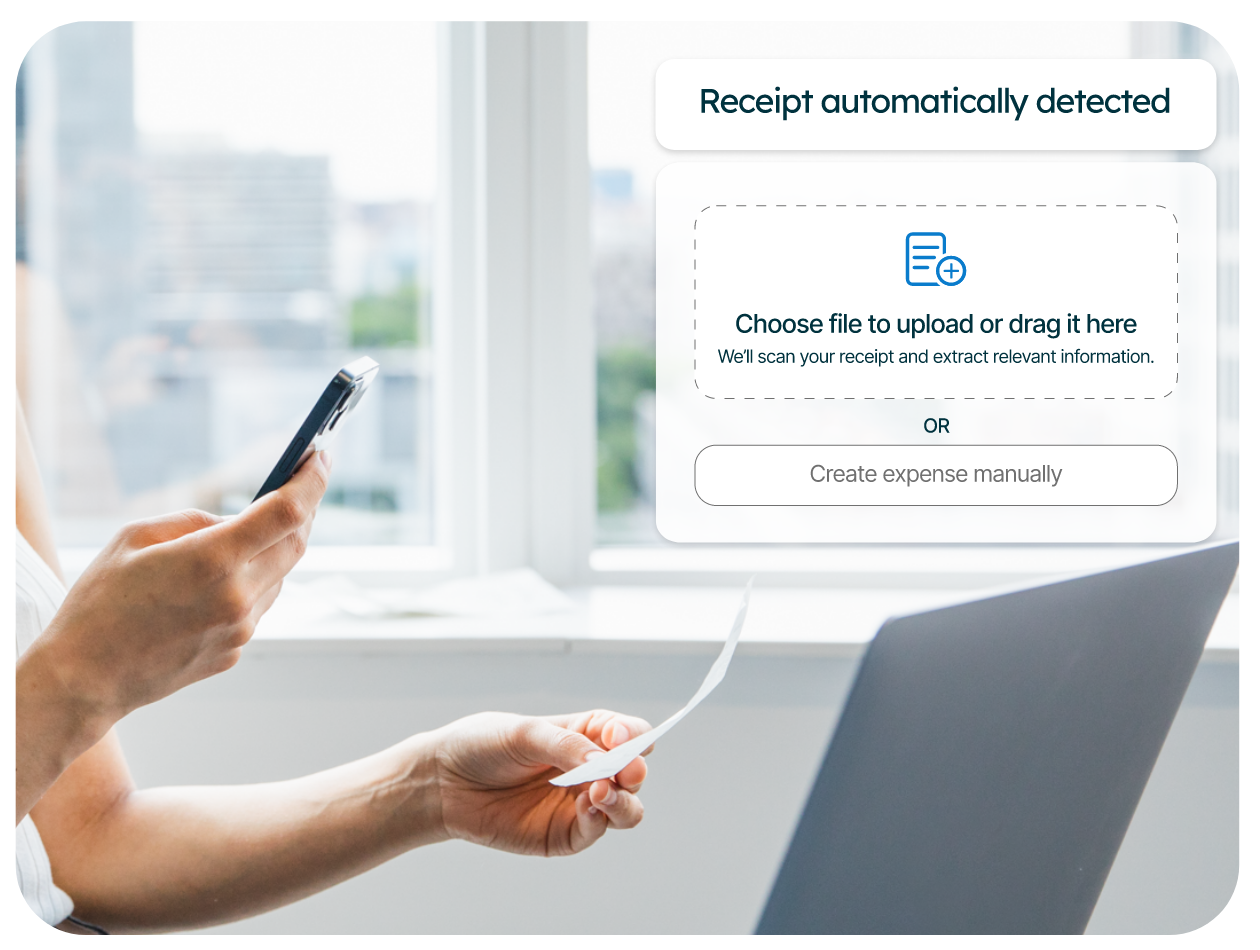

Real-time receipt capture with OCR

Declaree by Mobilexpense lets employees take a photo of a receipt directly from their smartphone. The app then uses OCR to extract key details - merchant, amount, date, and currency - and auto-fills the expense form. This reduces input errors and speeds up submission.

Automated policy enforcement

Corporate expense policies are built into the app. If an expense exceeds limits or breaches a rule, it’s flagged immediately. This ensures compliance without the need for manual policing and supports consistency across teams and regions.

Streamlined approval workflows

Submitted expenses move automatically through approval workflows based on pre-set rules. Routine expenses are processed quickly, while exceptions are flagged for additional review. Approvers can review, accept, or reject claims on their own mobile devices, no spreadsheets or email chains required.

Corporate card integration

Declaree matches card transactions with receipt data, enabling fast and accurate reconciliation.

Employees don’t need to manually input card charges, and finance teams gain a complete picture of spending without reconciling statements line by line.

Digital archiving and cloud backup

All expense data, including receipts and reports, is stored securely in the cloud.

There’s no need for physical filing or backups, records are accessible, searchable, and audit-ready whenever needed.

Built-in reporting tools

Managers can easily view expense trends, policy violations, and category breakdowns. This provides actionable insights to control costs, improve policy compliance, and optimise travel budgets.

Final thoughts

Mobile expense tracker apps empower employees to manage their expenses with minimal effort and maximum transparency. The result? Happier staff, faster reimbursements, reduced admin burden, and better visibility for finance teams. In today’s mobile, cloud-enabled world, there's little reason to stick with outdated, paper-based processes.

Ready to simplify expense management for your employees? Explore how Declaree can work for your team.

Frequently asked questions

It depends on your country’s regulations. In most European countries, receipts need to be kept for six to ten years for tax and audit purposes. In the US, the IRS recommends keeping them for three to seven years. The exact timeframe varies, but it’s always longer than most employees expect.

With an app, receipts are stored digitally in line with compliance rules. Employees don’t have to worry about the paper version getting lost or damaged.

If you lose a receipt, you might be asked to provide a signed statement (affidavit) or alternative proof of purchase. Some companies may reject the claim altogether. Inconsistent handling of lost receipts also creates unnecessary back-and-forth between employees and finance teams.

Apps make this problem disappear: employees can snap a photo at the point of purchase, and the receipt is instantly logged, timestamped, and matched to the transaction.

In many cases, no. For compliance and audit purposes, receipts are mandatory for most expenses. Some low-value purchases may be reimbursed without receipts, but this varies by company policy and tax regulations.

An app reduces stress for employees because every claim comes with digital proof, ensuring compliance without extra paperwork.

On this page:

Why employees love mobile apps?

1. Expense submission on the go

2. Fewer lost or damaged receipts

3. Time-saving simplicity

4. Access anytime, anywhere

5. Clarity and control over spending

6. Instant feedback and notifications

7. Faster reimbursements

How the mobile expense tracker app works?

Real-time receipt capture with OCR

Automated policy enforcement

Streamlined approval workflows

Corporate card integration

Digital archiving and cloud backup

Built-in reporting tools

Share this

You may also enjoy

these related stories

5 Signs You Need an Alternative to Bank Cards for Expenses

Per Diem Rates Table 2026 for Germany and International Travel

/Listing%20Images/The%20rise%20of%20AI%20+%20ML_Listing%20Image.png)

8 Key Things to Consider Before Adopting an Expense Solution in 2026

/Listing%20Images/Higher%20Tax-Free%20Mileage%20Allowance%20From%202023%20in%20the%20Netherlands%20%E2%80%93%201.png)