Ausgabenmanagement mit System

Mobilexpense automatisiert jeden Schritt des Ausgabenmanagements: Richtlinien werden geprüft, Belege ausgelesen, Abweichungen erkannt und Berichte direkt zur Genehmigung weitergeleitet.

%20Light.png?width=1363&height=375&name=Compliant%20(Logos)%20Light.png)

Entdecken Sie alle Mobilexpense-Produkte

Declaree

Declaree automatisiert Geschäftsreisen und Ausgabenmanagement für mittelständische Unternehmen in ganz Europa.

MXP

MXP automatisiert und steuert globales Ausgabenmanagement für große Unternehmen und Konzerne mit internationaler Präsenz.

Expense

Expense vereinfacht und automatisiert das Ausgabenmanagement für kleine und mittelständische Unternehmen in Skandinavien.

Ausgabenmanagement, das jede Ausgabe smart steuert

.gif?width=450&height=800&name=Declaree%20-%20AI%20receipt%20scanner%20(1).gif)

Belege erfassen ohne manuelle Eingabe

Unser Declaree by Mobilexpense KI-Belegscanner liest alle Daten aus und verarbeitet jede Ausgabe automatisch.

Genehmigende erhalten sofort Benachrichtigungen

Automatisieren Sie Freigaben nach Ihren Vorgaben. Weisen Sie Genehmigende zu, definieren Sie Workflows und informieren Sie Führungskräfte in Echtzeit.

Immer compliant – ganz automatisch

Ein System, das sicherstellt, dass Sie jederzeit konform mit internen Richtlinien und gesetzlichen Vorgaben bleiben.

Bewusstes Ausgeben bei Mitarbeitenden fördern

Beschleunigen Sie die Ausgabenprozesse mit automatisierten Einreichungen und Rückerstattungen.

Vertrauen stärken durch integrierte Compliance

Bleiben Sie regelkonform mit automatisierter Richtlinienprüfung und nahtlosen Integrationen

Ausgabendaten für strategische Entscheidungen

Echtzeit-Einblicke für bessere Budgets und nachhaltiges Wachstum.

Entwickelt mit Finanzteams – für mehr Effizienz und Kontrolle

Zeitersparnis bei Ausgaben

Lucien Bike Erfolgsgeschichte

Effizienzgewinn mit Mobilexpense-Karten

Conbit Erfolgsgeschichte

Transparenz über alle Ausgaben

Interne Datenauswertungen

Automatisiertes Ausgabenmanagement

Entdecken Sie die wichtigsten Funktionen für nahtlose Prozesse und weniger Aufwand

Ausgabenmanagement und Freigabe-Workflows

Behalten Sie den Überblick und gestalten Sie Freigaben nach Ihren Anforderungen.

Firmenkreditkarten

Bestehende Karten integrieren oder unsere Mobilexpense-Karten verwenden – mit detaillierter Ausgabenkontrolle.

/Mobilexpense%20brand%20image%20old11.png?width=800&height=650&name=Mobilexpense%20brand%20image%20old11.png)

Kilometererfassung und Tagespauschalen

Reisekosten unterwegs erfassen – mit automatischer Berechnung von Kilometerkosten und Pauschalen.

Verpflegungsmehraufwand (Tagespauschalen)

Erfasst automatisch alle relevanten Pauschalen gemäß EU-weiten Steuervorgaben.

/Mobilexpense%20brand%20image%20old26.png?width=800&height=650&name=Mobilexpense%20brand%20image%20old26.png)

CO₂-Tracking & Reporting

Ermitteln Sie den Klimaeinfluss Ihrer Reisen in Echtzeit und erstellen Sie auditfähige Berichte.

Richtlinieneinhaltung und Unternehmensregeln

Verstöße gegen interne Richtlinien automatisch erkennen, bevor Kosten entstehen.

Erfolgsgeschichten aus der Praxis – erzählt von unseren Kunden

„Dank der Kartenintegration haben wir mindestens 90 bis 95 % weniger Aufwand.“

Gerald Evers, CFO

„Ich importiere Ausgabenberichte heute in Minuten – früher hat das Stunden gedauert.“

Betty Bajec, HR- und Lohnabrechnungsadministratorin

„Die App ist sehr leicht zu verstehen. Sie ist wirklich gut.“

Benjamin Zajonskowski, Project Manager bei RIL

FAQ - Häufig gestellte Fragen

Mobilexpense ist der vertrauensvolle Partner von mehr als 3.000 Unternehmen weltweit und unterstützt sie dabei, ihr Ausgabenmanagement zu vereinfachen und zu automatisieren.

Wir bieten drei Lösungen an: Expense, Declaree und MXP – damit jedes Unternehmen, vom schnell wachsenden Team bis zum globalen Konzern, Ausgaben smarter und mit voller Kontrolle verwalten kann.

- Declaree by Mobilexpense vereinfacht die Reisekostenabrechnung für Kleinunternehmen sowie kleine und mittelständische Unternehmen. Die Lösung automatisiert das Erfassen von Belegen, die Prüfung von Richtlinien und die Rückerstattungen – alles in einer modernen, mobil optimierten Nutzererfahrung.

- MXP by Mobilexpense bietet eine leistungsstarke, zentralisierte Plattform für große und international tätige Unternehmen. Sie unterstützt komplexe Compliance-Anforderungen, Multi-Entity-Strukturen und länderübergreifende Finanzprozesse.

-

Expense by Mobilexpense: Entwickelt für kleinere Unternehmen in Skandinavien.

Expense automatisiert die tägliche Ausgabenerfassung und die Verwaltung von Firmenkartenabrechnungen. Teams erhalten mehr Transparenz über Ausgaben, schnellere Rückerstattungen und reibungslose Workflows – zur Entlastung der Mitarbeitenden.

Alle drei Produkte verfolgen dasselbe Ziel: Ausgabenmanagement zu vereinfachen und Finanzteams den Rücken freizuhalten, damit sie sich auf das konzentrieren können, was das Wachstum wirklich vorantreibt.

Beide Produkte gehören zur Mobilexpense-Familie, erfüllen jedoch unterschiedliche Anforderungen von Unternehmen.

-

Declaree by Mobilexpense eignet sich ideal für mittelständische Unternehmen, die eine schnelle Einführung und einfache Automatisierung wünschen. Die Lösung bietet eine benutzerfreundliche Oberfläche, ein mobil optimiertes Design und nahtlose Integrationen mit Buchhaltungssystemen wie Exact oder QuickBooks Online.

-

MXP by Mobilexpense wurde für große Unternehmen und Konzerne entwickelt, die komplexe Compliance-Vorgaben, Transaktionen in mehreren Währungen und umfangreiche Freigabeprozesse verwalten müssen. Die Plattform umfasst erweiterte Richtlinienkonfigurationen, Audit-Trails und eine globale Abdeckung steuerlicher Compliance.

Kurz gesagt: Declaree bringt Einfachheit und Geschwindigkeit, MXP Struktur und Skalierbarkeit. Beide liefern dasselbe Ergebnis – ein automatisiertes Ausgabenmanagement-System, das sich intuitiv bedienen lässt.

Sowohl MXP als auch Declaree erfüllen alle rechtlichen und finanziellen Vorgaben – einschließlich DSGVO – und werden in mehr als 70 Ländern eingesetzt.

MXP bietet erweiterte Compliance- und Kontrollfunktionen für international tätige Unternehmen und unterstützt komplexe Anforderungen. Declaree gewährleistet ein sicheres und konformes Ausgabenmanagement für europäische Unternehmen. Beide Lösungen automatisieren Prozesse, minimieren Risiken und sorgen für verlässlich korrekte Daten.

Bei Mobilexpense wissen wir, dass jedes Unternehmen Ausgaben anders verwaltet. Deshalb bieten wir drei Lösungen an, die auf unterschiedliche Anforderungen zugeschnitten sind.

Declaree by Mobilexpense unterstützt mittelständische Unternehmen, die manuelle Arbeit reduzieren und Ausgaben in Echtzeit überblicken möchten. Die Lösung eignet sich ideal für Finanzteams, die Wert auf Flexibilität, eine nutzungsfreundliche Oberfläche und eine schnelle Einführung legen.

MXP by Mobilexpense richtet sich an große und international tätige Unternehmen mit hohen Compliance-Anforderungen, länderübergreifenden Rollouts und zentralisierten Freigabeprozessen. Die Plattform gibt CFOs und Controllern volle Transparenz und sorgt dafür, dass Richtlinien in allen Unternehmensbereichen einheitlich angewendet werden.

Expense by Mobilexpense wird von kleineren Unternehmen in Skandinavien genutzt, die eine einfache und effiziente Ausgabenerfassung sowie eine reibungslose Verwaltung von Firmenkartenabrechnungen benötigen.

Ob Sie 50 Ausgaben im Monat verwalten oder 50.000 – Mobilexpense hilft Ihnen, vom Belege-Nachjagen zur strategischen Steuerung zu wechseln.

KI unterstützt die Automatisierung in sowohl Declaree als auch MXP und hilft Unternehmen dabei, Zeit zu sparen, Fehler zu reduzieren und Compliance sicherzustellen.

- Declaree by Mobilexpense nutzt KI, um Belege in Sekunden zu erfassen, zu kategorisieren und zu prüfen. Der KI-gestützte Belegscanner erkennt automatisch alle relevanten Informationen, markiert doppelte Einreichungen und wendet Unternehmensrichtlinien in Echtzeit an.

- MXP by Mobilexpense geht noch einen Schritt weiter: Die KI überprüft Richtlinien, erkennt Anomalien und liefert Einblicke in Ausgabentrends – über verschiedene Länder, Einheiten und Teams hinweg.

So ermöglicht Mobilexpense Finanzteams präzise Daten und schnellere, fundierte Entscheidungen.

Nach der Implementierung steht Ihnen ein erfahrenes Support-Team sowie eine persönliche Ansprechperson zur Seite, die Sie auf jedem Schritt begleitet.

Von der Einführung und Schulung bis zur langfristigen Optimierung sorgt Mobilexpense dafür, dass Sie den maximalen Nutzen aus Ihrer Lösung ziehen. Unsere Zusammenarbeit endet nicht mit dem Go-Live – wir unterstützen Sie dabei, Ihre Prozesse weiterzuentwickeln, während Ihr Unternehmen wächst.

Und wenn Sie schnelle Antworten benötigen, ist unser Support-Team jederzeit über das Support-Portal für Sie erreichbar.

Declaree by Mobilexpense

Declaree wurde für Kleinunternehmen und mittelständische Unternehmen entwickelt und eignet sich ab einer Mindestnutzung von etwa 20 Mitarbeitenden. Die Lösung bietet intuitive Automatisierung, nahtlose Integrationen mit Buchhaltungssystemen und flexible Firmenkarten – und ermöglicht damit Effizienz auf Enterprise-Niveau, ohne die damit verbundene Komplexität.

MXP by Mobilexpense

MXP richtet sich an große Unternehmen und Konzerne mit komplexen Strukturen. Die Plattform bietet zentralisierte Kontrolle über Ausgaben, regulatorische Compliance in über 70 Ländern und erweiterte Workflows, die sich an länderübergreifende Richtlinien und unterschiedliche Unternehmensstrukturen anpassen.

Expense by Mobilexpense

Entwickelt für Kleinunternehmen in Skandinavien. Expense vereinfacht die tägliche Ausgabenerfassung und die Verwaltung von Firmenkartenabrechnungen. Die automatisierte Plattform bietet Teams mehr Transparenz über Unternehmensausgaben, schnellere Rückerstattungen, reibungslosere Workflows – und zufriedenere Mitarbeitende.

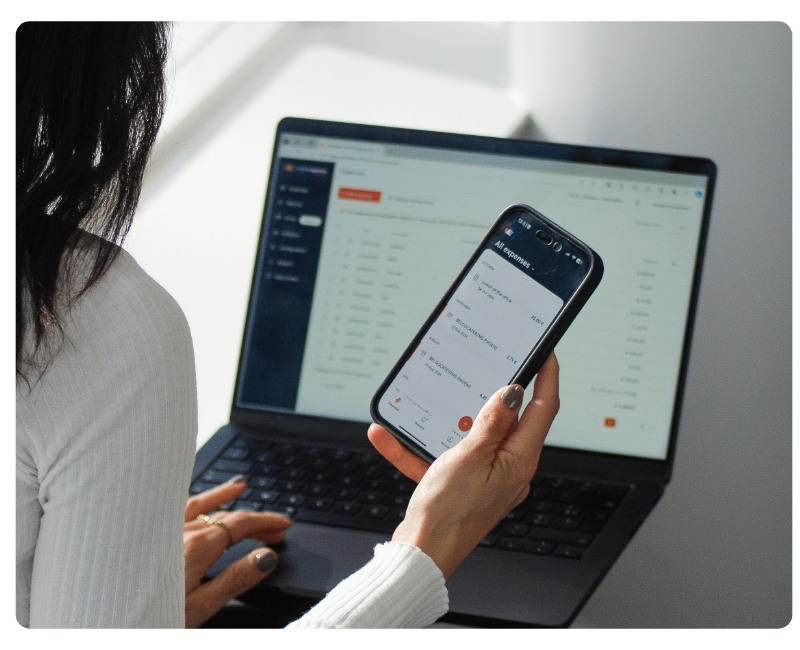

Ja. Alle Mobilexpense-Produkte verfügen über intuitive mobile Apps, die für Mitarbeitende entwickelt wurden, die viel unterwegs sind.

Mit der App können Nutzende Belege fotografieren, Kilometer erfassen und Ausgaben in Echtzeit einreichen.

Das System liest die Daten automatisch aus dem Beleg aus, berücksichtigt Unternehmensrichtlinien und leitet die Ausgabe sofort zur Genehmigung weiter.

Entdecken Sie fundiertes Fachwissen, das Sie sicher durch die moderne Finanzwelt führt

Leitfaden: Die richtige Software für Ihr Ausgabenmanagement finden

Die Wahl der richtigen Ausgabenmanagement-Software muss nicht kompliziert sein. Dieses E-Book bietet Ihnen eine klare, praxisnahe Anleitung, mit der Sie den Auswahlprozess sicher meistern. Lernen Sie, Anbieter richtig zu bewerten, die entscheidenden Funktionen zu erkennen und die Lösung zu finden, die wirklich zu Ihrem Unternehmen passt.

Von Bankkarten zu smarten Firmenkreditkarten: Was CFOs wissen müssen

Dieses E-Book erklärt die wichtigsten Themen rund um Firmenkreditkarten und Geschäftsausgaben. Es zeigt Ihnen, wie sich alltägliche Hürden mithilfe smarter Prozesse und transparenter Workflows in klare Vorteile verwandeln lassen.

Compliance im Ausgabenmanagement

Dieser Leitfaden unterstützt Sie dabei, bevorstehende Compliance-Änderungen frühzeitig zu verstehen und gezielt darauf zu reagieren. Erfahren Sie, wie sich E-Rechnungspflichten und Nachhaltigkeitsberichterstattung verändern – und welche Auswirkungen dies auf Ihre Finanzabläufe und Ihr Ausgabenmanagement hat.

Einsteigerleitfaden für Ausgabenmanagement mit maximaler Effizienz

Neu im Ausgabenmanagement oder unsicher, wo Sie anfangen sollen? Dieser Leitfaden erklärt die wichtigsten Grundlagen – von klaren Richtlinien über automatisierte Abläufe bis hin zu effizienter Ausgabenerfassung. Sie erfahren, wie Sie ein strukturiertes, rechtskonformes System aufbauen, das Zeit spart, Fehler reduziert und Ihrem Finanzteam volle Kontrolle gibt.

Buchen Sie eine Demo mit Mobilexpense

-

Eine Live-Demo, die sich an den Abläufen und Freigabeprozessen Ihres Unternehmens orientiert.

-

Expertenrat zur Integration Ihrer ERP-, HR- und Kartensysteme für reibungslose Prozesse.

-

Effizienz ab dem ersten Tag – sparen Sie Zeit, automatisieren Sie Richtlinien und skalieren Sie mühelos.

-png-4.png?width=1391&height=322&name=Ratings%20Banner(Desktop)-png-4.png)