pleo alternative

Why finance teams look beyond Pleo

Declaree by Mobilexpense combines full-stack expense management with powerful credit-card control - built for European finance teams that need flexibility, compliance, and automation.

%20Light.png?width=1363&height=375&name=Compliant%20(Logos)%20Light.png)

![[Solution] Travel_Above fold (ENG)](https://www.mobilexpense.com/hs-fs/hubfs/1-Images/Website%20pages/New%20Website%20Visuals%202024/2.%20Solution%20Pages/Travel%20Management/ENG/%5BSolution%5D%20Travel_Above%20fold%20(ENG).png?width=1200&height=950&name=%5BSolution%5D%20Travel_Above%20fold%20(ENG).png)

Spend 95% less time managing travel expenses

Mobilexpense’s corporate travel expense management software:

Keeps costs in check

Simplifies approvals

Integrates with your existing travel tools

Gives travellers the freedom while remaining in full control over budgets, compliance, and reporting.

Book a demo

.png?width=1080&height=1080&name=SpendLab%20(4).png)

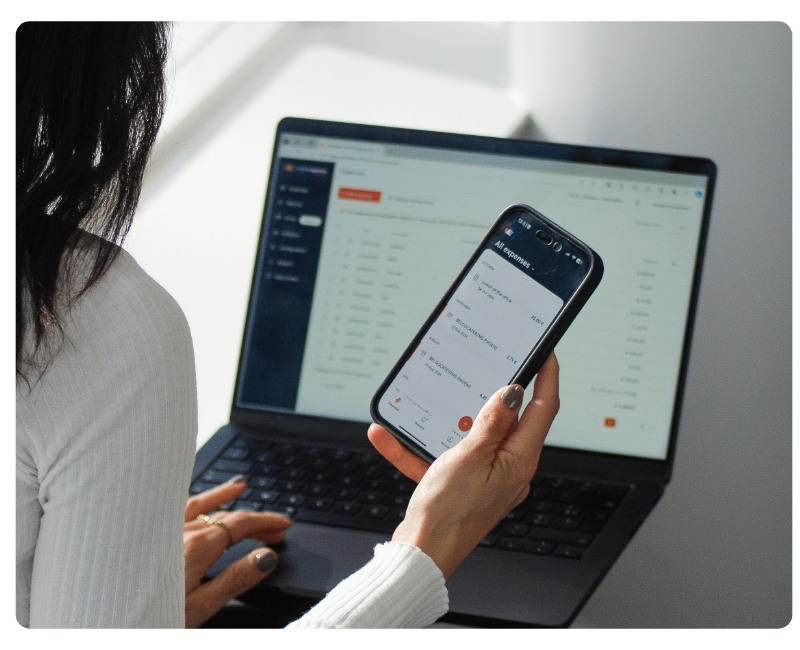

Pleo focuses on cards. Declaree focuses on control.

While Pleo supports small teams issuing debit cards,

Declaree goes further with a full expense solution for growing companies.

.png?width=1200&height=950&name=Landing%20Page%20Cards%20Image%201%20(ENG).png)

Integrate your own business credit cards

Compatible with Visa, Mastercard, and AirPlus feeds.

Flexible integrations

Connect to Exact Online, DATEV, AFAS, Twinfield and more within minutes.

End-to-end expense management

Not just cards. Manage travel, reimbursements, and reporting in one place.

Declaree vs Pleo comparison at a glance

Backed by customer testimonials and real-world results

"It's at least 90% to 95% less work for us thanks to the card integration"

Gerald Evers, CFO

"I can import expense reports in just a few minutes. It used to take hours"

Betty Bajec, HR and Payroll Administrator

"The app is very easy to understand. It’s really good."

Benjamin Zajonskowski, Project manager at RIL

Discover real benefits

Automated mileages

Daily allowances

Rules and workflows

Expense policies

Multilingual support

Accounting and ERP connection

Curious about the cost of simplifying your expenses?

If you are checking the Pleo price or searching for a Pleo demo, here is how our pricing works: starting from €8 per month and designed to help you save far more across your company spend.

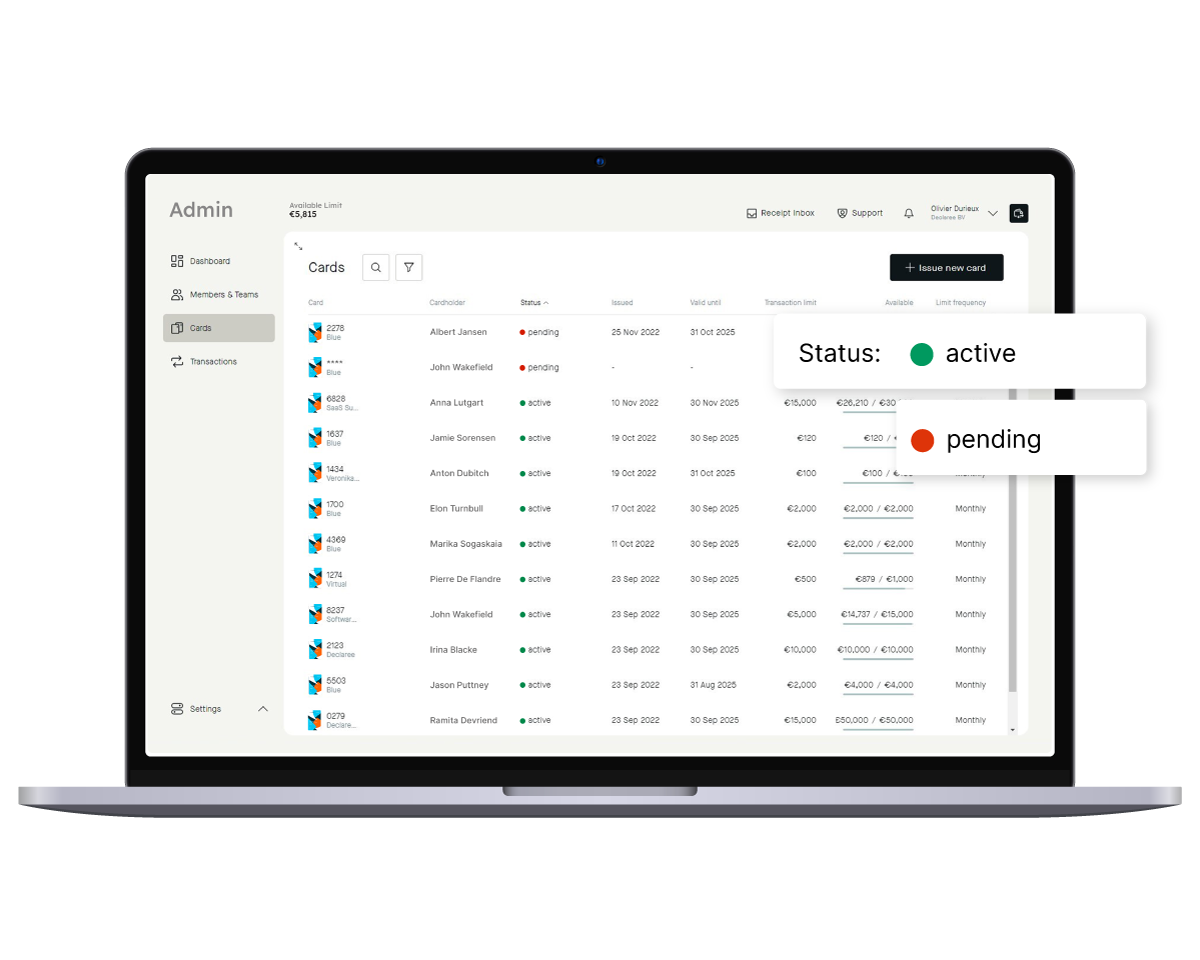

Manage all business credit cards online and in real-time

Instantly issue or block business credit cards, manage lost cards, pin codes and more from our online application’s central dashboard. Manage spend and employee cards from one application. And you won't ever have to set foot in a bank.

Automated policy enforcement ensures that expenses are compliant. Combined with a real-time view on expenses, overspending becomes nearly impossible.

These customers use our CO2 emissions tracking tool

Understanding the Dutch Government's CO2 Reporting Requirements

In response to the growing concerns about climate change and the Netherlands' commitment to reducing CO2 emissions, the Dutch government introduced new legislation to monitor and manage the environmental impact of work-related travel. This legislation, known as the "Rapportageverplichting werkgebonden personenmobiliteit (WPM)", mandates organisations with a workforce of 100 or more to provide detailed reports on the CO2 emissions resulting from their employees' business and commuting travels.

Starting from 1 January 2024, if your organisation falls into this category, you'll be required to maintain a record of the CO2 emissions from both business trips and daily commutes of your employees. This data will play a crucial role in the country's efforts to understand and reduce the carbon footprint of work-related travels, which currently account for a significant portion of the total kilometers driven in the Netherlands. The deadline for submitting the required data for the year 2024 is set for 30 June 2025.

This move by the government not only emphasizes the importance of environmental responsibility but also underscores the role employers play in promoting sustainable travel options and practices.

For a comprehensive understanding of these requirements and to ensure your organization remains compliant, the official RVO website offers detailed insights.

-3.png)

Join the movement of CO2 emissions tracking

CO2 emissions tracking is at the forefront of sustainable business practices. Find out more about what emissions tracking is, why it's necessary, the tools you can use for it and the benefits for your company - and the planet.

Customers using our company cards

"Mobilexpense is a real game-changer for us."

Our Mobilexpense solution is a real game-changer for us. With the convenience of self-issued credit cards for employees and seamless integration of claims data for administration, we not only save valuable time but also have complete control over our expenses. Efficiency and convenience come together in this super service. For our international projects, we now even give temporary cards to freelancers with a set expiry date. For office workers, a virtual card. Super convenient.

"[We] have reduced the time needed to manage expenses by 50%."

The integration of credit cards with the expense application has reduced the amount of lost receipts, accelerated the expense claims and contributes to a general smoothening of our expense management. It was easily deployed and accepted by the people and has reduced the time needed to manage expenses by 50%.

"It's a win-win for efficiency and trust!"

The new Mobilexpense cards provide complete card management for us at Ovotrack, making it super easy to order and distribute new cards, but also to set limits to transactions or monthly spend, and have real-time insight in all transactions. Our employees value their independence and the ability to manage their spending in real-time using either a plastic or virtual card, directly linked to their mobile app. It's a win-win for efficiency and trust!

Frequently asked questions

If you are comparing Pleo alternatives or exploring Pleo competitors, here is what you need to know before choosing your next expense management solution.

Pleo works well as a card-first tool for small teams.

Declaree by Mobilexpense is a full-stack expense-management platform combining credit cards, receipts, reimbursements, approvals, reporting, and integrations in one system — purpose-built for European finance teams that need flexibility, compliance, and automation.

- Built for the European mid-market: Mobilexpense works with compliance, multi-currency, multi-language and local accounting standards.

- Ease of use for employees and finance: Snap a receipt, automatic workflows, fewer manual steps.

- Flexible card / feed model (you can integrate your existing cards - (Visa/Mastercard/AirPlus/Amex)) and scalable for companies of various sizes.

- It combines strong automation (OCR receipt capture, multi-VAT recognition, policy rules) with a rollout-friendly model: most customers go live quickly and adopt without heavyweight projects.

- Transparent cost control and avoidance of unnecessary fees (which many competitors introduce).

- It emphasises user experience (mobile app, offline capture accessible) and finance control equally — rather than focusing just on employee spend or just on procurement.

In short: Declaree by Mobilexpense positions itself as a strategic platform for expense control + compliance + operations — not just another card or travel-expense tool.

Declaree is ideal for organisations that:

- Operate across multiple countries (especially NL, BE, DE) and need finance/compliance tools that reflect regional rules.

- Want to keep flexibility (existing cards, different payment methods) rather than be locked into one proprietary card system.

- Seek to automate expense workflows, reduce manual VAT splits, and gain visibility for finance teams (not just for individual users).

- Want a go-live timeframe without a massive multi-quarter project — preferring a smoother implementation with best-practice templates.

Yes. Integration is a core capability of Declaree. You can connect your existing accounting/ERP system (such as Exact Online, DATEV, Twinfield and others) to ensure your expense data flows into finance workflows.

Behind the scenes, we support the mappings, policy logic, audit-ready data exports, and receipt-matching automation needed for end-to-end process efficiency.

So if your team uses a central finance system, you won’t need to treat expenses in isolation — Declaree becomes a part of your workflow rather than a bolt-on.

Declaree is a modern, cloud-based expense management platform built for European finance teams. It’s developed and supported by Mobilexpense, a company dedicated to simplifying expense workflows, automations and compliance across the region.

With Declaree, you get user-friendly receipt capture, policy automation, ERP/finance system integrations and local support — all backed by Mobilexpense’s expertise in the field.

By choosing Declaree, you’re working with a vendor that treats expense management not just as software, but as a part of your finance operation strategy.

Yes:

- If you require extremely heavy customisation or very large enterprise-scale integrations, it is worth reviewing the implementation scope. Declaree is built for mid-market companies and can scale, but if you are an enterprise customer, MXP by Mobilexpense may be a better fit for your needs.

- CO₂ and ESG tracking: This functionality is available as an add-on rather than a default feature, so it is not included in every package.