Looking for an alternative to Payhawk?

Thousands of finance teams in Europe switched to Mobilexpense for better control, flexibility, and support

Stop the 2% tax on every foreign swipe.

Capture receipts, even in aeroplane mode.

Brand the app as yours, not ours.

.png?width=1200&height=950&name=Landing%20Page%20Travel_Above%20fold%20(ENG).png)

![[Solution] Travel_Above fold (ENG)](https://www.mobilexpense.com/hs-fs/hubfs/1-Images/Website%20pages/New%20Website%20Visuals%202024/2.%20Solution%20Pages/Travel%20Management/ENG/%5BSolution%5D%20Travel_Above%20fold%20(ENG).png?width=1200&height=950&name=%5BSolution%5D%20Travel_Above%20fold%20(ENG).png)

Spend 95% less time managing travel expenses

Mobilexpense’s corporate travel expense management software:

Keeps costs in check

Simplifies approvals

Integrates with your existing travel tools

Gives travellers the freedom while remaining in full control over budgets, compliance, and reporting.

Book a demo

3.000+ customers trust us with expenses

markup on Mobilexpense credit cards

vs Payhawk with 1.99% – 2.99% mark-up.

active user rate

thanks to offline OCR and modern user experience.

receipt and invoice capture success rate

thanks to an offline AI receipt scanner.

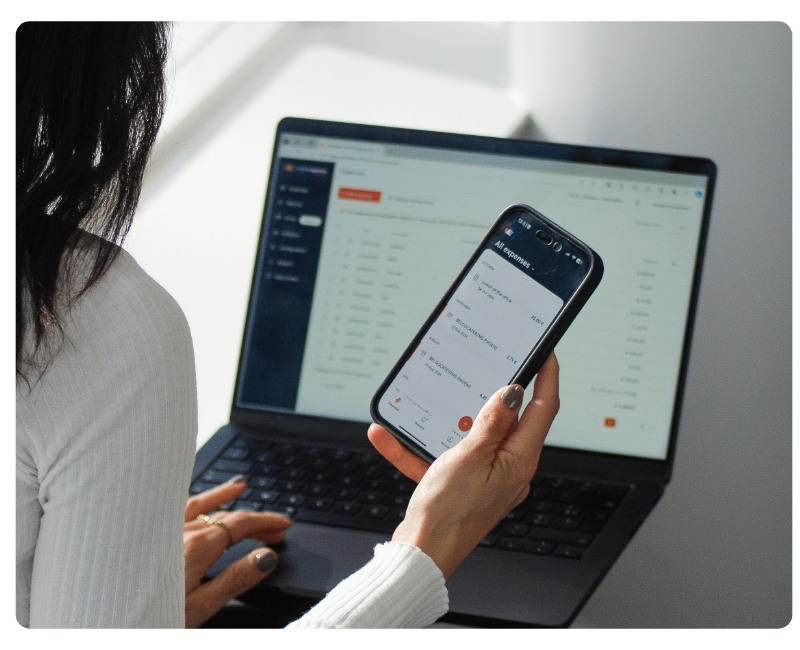

Declaree is the fast-lane Payhawk alternative

Keep your own credit cards, settle reports and

automate per diems, VAT, CO₂ tracking.

.png?width=1200&height=950&name=Landing%20Page%20Cards%20Image%201%20(ENG).png)

Integrate your own business credit cards

Virtual or physical, empower your employees with Mobilexpense business credit cards, eliminating out-of-pocket expenses while ensuring full control over company spending.

Embrace efficiency with automation

Declaree’s intuitive mobile app simplifies the expense reporting process, allowing employees to scan receipts instantly, reducing friction and time spent on administrative tasks.

Take back control with full visibility

Regain control over expenses with automated business rules, approval workflows, and policy enforcement. Establish well-integrated policies based on custom field variables.

Keep existing bank cards, split VAT rates

and close month-end 4× faster

"Over the past decade, Mobilexpense has proven to be one of the best tools I’ve worked with."

Hanspeter Wittwer

Former Global Travel Manager at Autoneum

"Mobilexpense had the most attractive offer for us. They provided the functionalities we were looking for and they were responsive to specific questions we had."

Marielle ten Rouwelaar

Secretary & Office Manager for Rugby Netherlands

"It's at least 90 to 95% less work for us now thanks to the card integration, compared to the previous paper and Excel process.

Gerald Evers

CFO at Lucien Bikes

Discover real benefits. What's in it for you?

Automated mileages

Daily allowances

Rules and workflows

Expense policies

Multilingual support

Accounting and ERP connection

Curious about the cost of simplifying your expenses?

Start for as little as €8 per month and save way more on your expenses

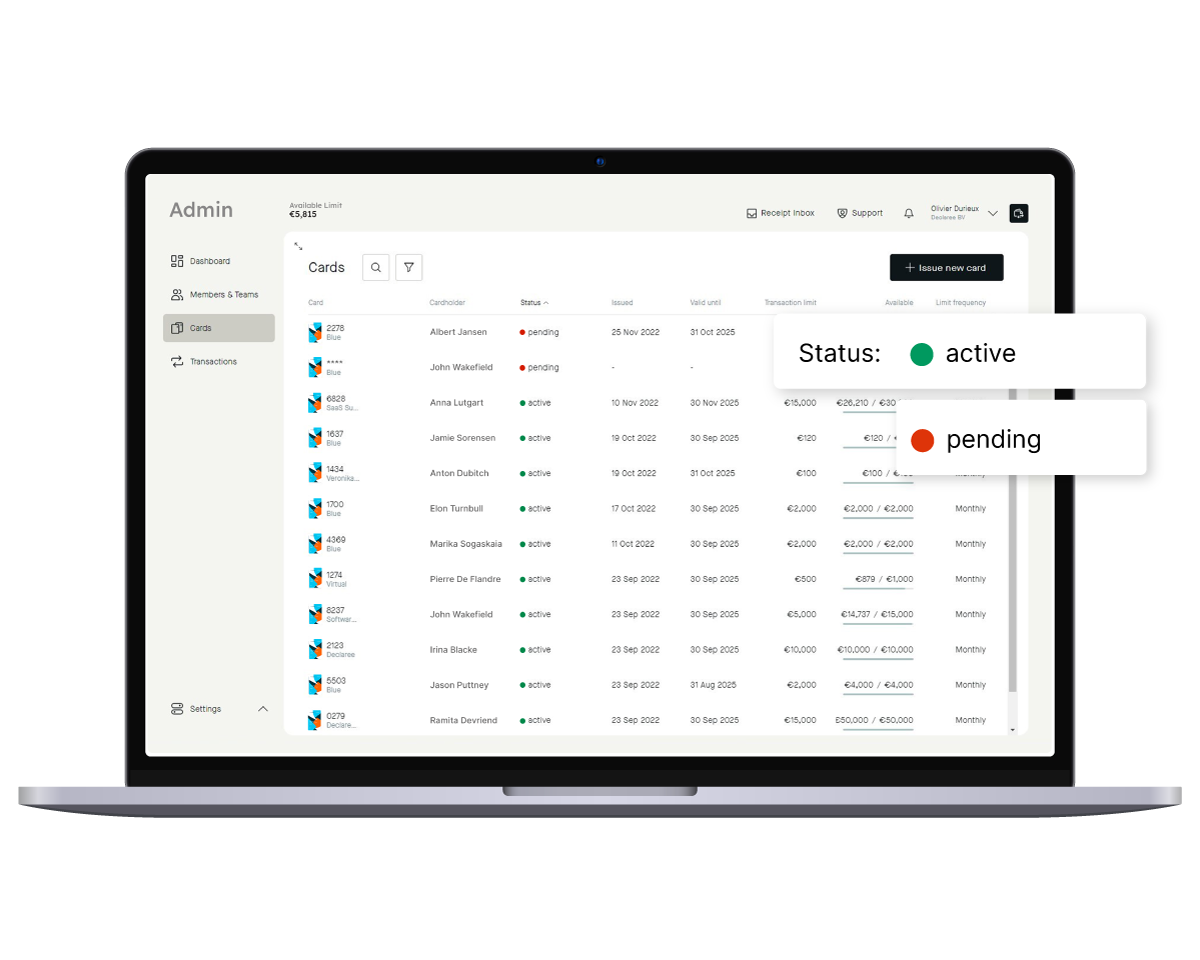

Manage all business credit cards online and in real-time

Instantly issue or block business credit cards, manage lost cards, pin codes and more from our online application’s central dashboard. Manage spend and employee cards from one application. And you won't ever have to set foot in a bank.

Automated policy enforcement ensures that expenses are compliant. Combined with a real-time view on expenses, overspending becomes nearly impossible.

These customers use our CO2 emissions tracking tool

Understanding the Dutch Government's CO2 Reporting Requirements

In response to the growing concerns about climate change and the Netherlands' commitment to reducing CO2 emissions, the Dutch government introduced new legislation to monitor and manage the environmental impact of work-related travel. This legislation, known as the "Rapportageverplichting werkgebonden personenmobiliteit (WPM)", mandates organisations with a workforce of 100 or more to provide detailed reports on the CO2 emissions resulting from their employees' business and commuting travels.

Starting from 1 January 2024, if your organisation falls into this category, you'll be required to maintain a record of the CO2 emissions from both business trips and daily commutes of your employees. This data will play a crucial role in the country's efforts to understand and reduce the carbon footprint of work-related travels, which currently account for a significant portion of the total kilometers driven in the Netherlands. The deadline for submitting the required data for the year 2024 is set for 30 June 2025.

This move by the government not only emphasizes the importance of environmental responsibility but also underscores the role employers play in promoting sustainable travel options and practices.

For a comprehensive understanding of these requirements and to ensure your organization remains compliant, the official RVO website offers detailed insights.

-3.png)

Join the movement of CO2 emissions tracking

CO2 emissions tracking is at the forefront of sustainable business practices. Find out more about what emissions tracking is, why it's necessary, the tools you can use for it and the benefits for your company - and the planet.

Customers using our company cards

"Mobilexpense is a real game-changer for us."

Our Mobilexpense solution is a real game-changer for us. With the convenience of self-issued credit cards for employees and seamless integration of claims data for administration, we not only save valuable time but also have complete control over our expenses. Efficiency and convenience come together in this super service. For our international projects, we now even give temporary cards to freelancers with a set expiry date. For office workers, a virtual card. Super convenient.

"[We] have reduced the time needed to manage expenses by 50%."

The integration of credit cards with the expense application has reduced the amount of lost receipts, accelerated the expense claims and contributes to a general smoothening of our expense management. It was easily deployed and accepted by the people and has reduced the time needed to manage expenses by 50%.

"It's a win-win for efficiency and trust!"

The new Mobilexpense cards provide complete card management for us at Ovotrack, making it super easy to order and distribute new cards, but also to set limits to transactions or monthly spend, and have real-time insight in all transactions. Our employees value their independence and the ability to manage their spending in real-time using either a plastic or virtual card, directly linked to their mobile app. It's a win-win for efficiency and trust!

Frequently asked questions

Declaree is fully card-agnostic. You can continue using your existing Visa, Mastercard, or Amex cards. In contrast, Payhawk requires customers to switch to their own card infrastructure, which can include volume thresholds and restrictions.

Declaree does not charge any FX markup, making it a cost-neutral choice for international transactions. Payhawk applies a 2% FX markup on EUR, GBP, USD, BGN, PLN, and RON cards—and 3% for US-based cards.

Yes. Unlike Payhawk, which may require a minimum annual card transaction volume of €500k to €1m for credit lines.

Declaree has no such thresholds and works with businesses of all sizes.

Yes. Declaree allows for splitting multiple EU VAT rates on a single invoice. Payhawk cannot automatically recognise which country the VAT line should be coded to.

Absolutely. Declaree’s mobile app can capture and draft receipts even while offline, making it ideal for frequent travellers or remote workers.

Yes. Declaree offers a white-label interface for partners, ideal for resellers or companies looking to provide a fully branded expense management solution.

Pick the perfect spend management solution for your business.

Looking for more than just spend limits and fancy cards?

Declaree offers deep receipt recognition with VAT mapping, local support in NL and DE, and custom branding—plus all the essentials like virtual and physical cards.

Talk to an expert to explore a smarter, more personal way to manage business spend.

%20Option%201.png?width=1200&height=950&name=Data%20%26%20Insights_Above%20fold%20(ENG)%20Option%201.png)